Benefits of Future Path 529

Tax Advantages

Qualified Expenses

Gifting

Upromise®

Limited Impact on Financial Aid

No Enrollment Fee

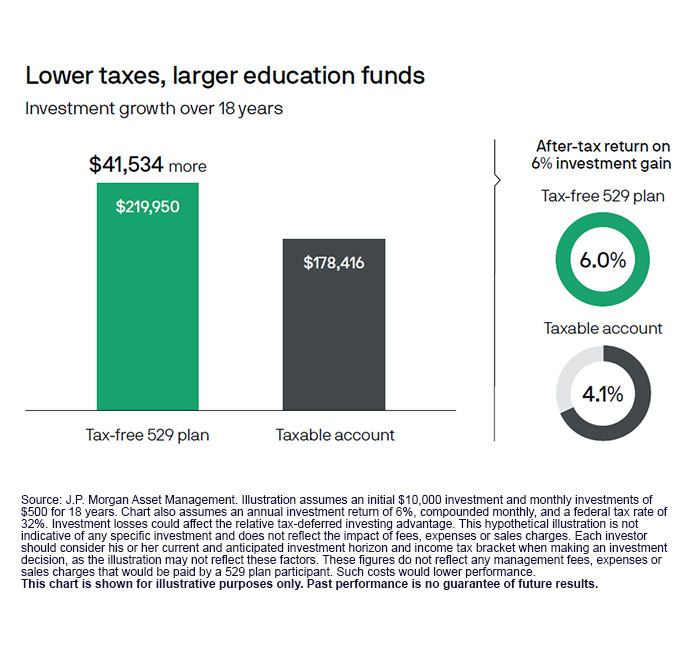

Tax Advantages

Federal tax-free qualified withdrawals.

Withdrawals used to pay for qualified higher education expenses are free from federal income tax, so more of your money can go towards college.*

Estate tax benefits.

Future Path 529 Account Owners can contribute up to $18,000 per beneficiary each year ($36,000 for married couples filing jointly) without incurring federal gift-tax consequences. You can choose to contribute up to $90,000 per child in a single year ($180,000 for married couples) and take advantage of five years' worth of tax-free gifts at one time.^ (Contributions are considered completed gifts and are removed from your estate, but you, as the account owner, retain control)

Join our 529 savings webinar to learn more

Join us to learn about the benefits of Future Path 529 - Nevada's 529 college savings plan to help you save for future educational expenses.

*Earnings on nonqualified withdrawals are subject to federal income tax and may be subject to a 10 percent federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent upon meeting other requirements.

**Upromise rewards is an optional service offered by Upromise, Inc., is separate from the Future Path 529 Plan, and is not affiliated with the State of Nevada. Terms and conditions apply to the Upromise service. Participating companies, contribution levels, and terms and conditions are subject to change at any time without notice.

***If the account owner or beneficiary does not have a Nevada permanent address or mailing address on file, or is not invested in the JPMorgan Stable Asset Income Portfolio, a $20 annual maintenance fee will be assessed.

^In the event the donor does not survive the five-year period, a pro-rated amount will revert to the donor's taxable estate.